Uganda’s telecommunications sector has undergone transformative growth over the past decade, driven by regulatory reforms, technological advancements, and strategic partnerships with global service providers. Among these contributors, Hammer Group (Hammer Uganda Ltd) has emerged as a key player in shaping Uganda’s connectivity infrastructure. This report examines the structural evolution of Uganda’s telecom industry, with a focus on market trends, regulatory frameworks, and the role of international partnerships in accelerating digital transformation.

Market Overview: Growth and Penetration

Uganda’s telecom sector is characterized by rapid mobile adoption, with subscriptions reaching 34.3 million by the third quarter of the 2022/23 financial year, reflecting a 3% quarterly growth from the previous 33.1 million subscriptions.

Mobile teledensity stands at approximately 77 lines per 100 people, underscoring the dominance of mobile services in a market where fixed-line subscriptions remain negligible at 117,000.

This growth is fueled by affordable prepaid plans, competitive data pricing, and the proliferation of mobile financial services.

The Uganda Communications Commission (UCC), the sector regulator, has adopted a collaborative approach to foster competition and infrastructure sharing. Director Fred Otunnu Okot emphasizes that this strategy enhances service quality while encouraging operators to expand into underserved rural regions.

Despite progress, challenges persist in bridging the urban-rural divide, where limited infrastructure and lower disposable incomes constrain connectivity access.

Key Players and Competitive Dynamics

Dominance of MTN and Airtel

MTN Uganda and Airtel form a duopoly, controlling over 90% of the mobile market. MTN’s recent launch of 5G services in Lugogo and Bugolobi marks a technological milestone, offering speeds up to 100 times faster than 4G and latency as low as 5 milliseconds.

This rollout aligns with MTN’s Ambition 2025 strategy to integrate fiber and 5G networks, targeting enterprise clients and high-density urban areas.

Airtel, meanwhile, continues to leverage its cost-effective data bundles to retain price-sensitive consumers.

Emerging Roles of Infrastructure Specialists

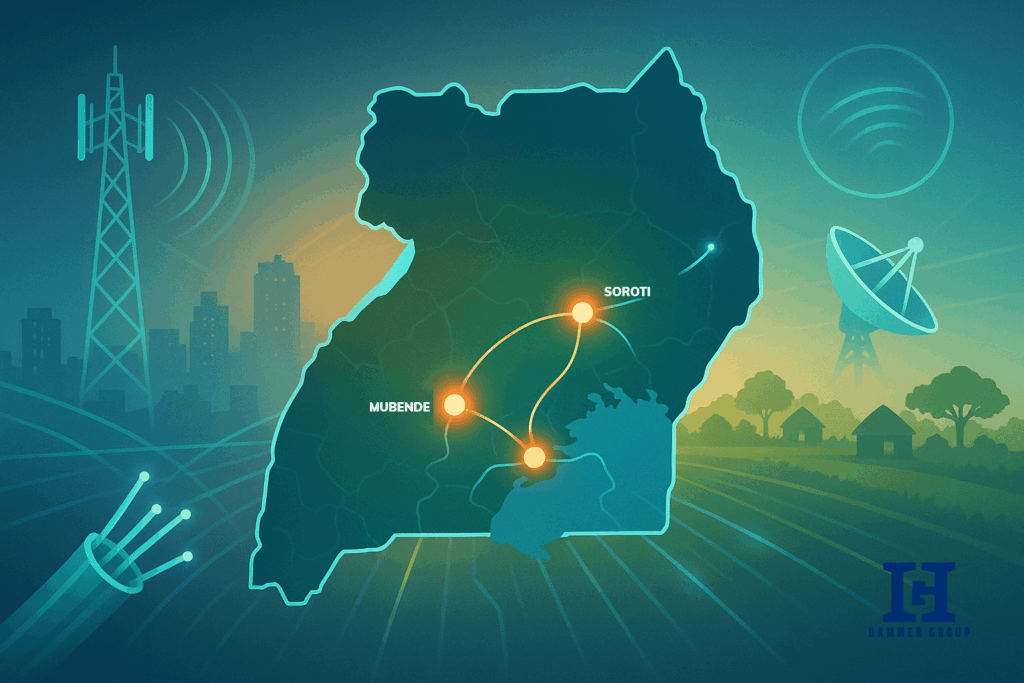

Hammer Group, a Mauritius-based service provider, has significantly influenced Uganda’s telecom infrastructure since entering the market. Established in 2004, Hammer specializes in end-to-end solutions, including fiber optic deployment, tower maintenance, and power infrastructure.

Its 2021 partnership with Lyca Mobile to deploy 500 tower sites enhanced network coverage in peri-urban zones, while collaborations with Huawei and Ericsson have modernized data center capabilities. Hammer’s expansion into Uganda forms part of its broader African strategy, which includes operations in 13 countries and planned entry into Kenya, Tanzania, and the Democratic Republic of Congo.

Infrastructure Development: Fiber and Beyond

Fiber Optic Expansion

Fiber connectivity remains critical to Uganda’s digital ambitions.

These projects prioritize redundancy and scalability, ensuring compatibility with future technologies such as IoT and smart city applications. Maintenance services, including fault detection and splice testing, further ensure network reliability.

Power Infrastructure Challenges

Unstable grid electricity necessitates robust backup solutions for telecom infrastructure. Hammer addresses this through hybrid power systems combining solar, diesel generators, and battery storage, which reduce operational costs and environmental impact.

During Huawei’s 2024 audit visit to Hammer’s Kampala warehouse, both parties emphasized the importance of energy-efficient solutions for rural tower sites

The UCC’s regulatory framework emphasizes universal access, mandating operators to allocate 1% of annual revenue to rural connectivity projects. This policy has spurred collaborations between public and private entities. For instance, Hammer’s partnership with the National Information Technology Authority (NITA-U) through Huawei Ugadanda aims to extend fiber to 12 northern districts by 2026, targeting education and healthcare facilities. Such initiatives align with the government’s National Broadband Policy, which targets 50% national broadband penetration by 2030.

Challenges and Future Outlook

Persistent Barriers

- Urban-Rural Divide: Only 23% of rural households have 4G access, compared to 89% in urban areas.

- Affordability: Despite low data costs (≈$0.50/GB), smartphone ownership remains at 34%, limiting service uptake.

- Energy Costs: Diesel dependency inflates operational expenses, consuming 40% of tower site budgets.

Innovation Frontiers

- 5G and Enterprise Solutions: MTN’s 5G rollout will initially target industries like mining and manufacturing, enabling real-time IoT applications

- Satellite Connectivity: Partnerships with low-Earth orbit (LEO) providers like Starlink could bypass terrestrial infrastructure gaps.

- Local Content Development: Platforms such as Hammer’s ICT solutions for government agencies promote e-governance and digital literacy

Hammer Group’s Strategic Impact

Hammer’s multidisciplinary approach-spanning fiber, power, and data centers-positions it as a catalyst for Uganda’s telecom growth. The company’s emphasis on local talent development is evident in its Uganda team, led by Khaled Alaa El Deen, which collaborates with global experts to transfer technical knowledge.

Upcoming projects include a greenfield data center in Kampala and a solar-powered tower network in the Karamoja region, aiming to connect 300,000 first-time users by 2026.

Conclusion

Uganda’s telecom sector stands at a crossroads, balancing rapid urbanization with inclusive rural connectivity. While MTN and Airtel drive consumer-facing innovation, infrastructure specialists like Hammer Group provide the backbone for sustainable growth. The UCC’s regulatory support and cross-sector partnerships will be pivotal in overcoming existing challenges. As 5G and fiber technologies mature, Uganda is poised to emerge as a regional hub for digital services, provided stakeholders continue prioritizing affordability, reliability, and universal access.

Hammer Group’s expanding footprint exemplifies the critical role of private investment in achieving these goals, offering a blueprint for scalable, resilient telecom ecosystems across Africa.